The August employment report reveals the U.S. economy is weaker than initially reported. With job creation at recession-level lows and unemployment measures rising, the labor market is signaling a clear slowdown.

In this month’s 10-minute outlook, Board Principal Economist Natalie Gallagher explains what the labor data means for Federal Reserve policy, inflation, and business planning in the months ahead.

This update covers:

- Why the data shows the economy is weaker than initially reported

- How sectoral divides reveal resilience in essential services but contraction in goods production and business services

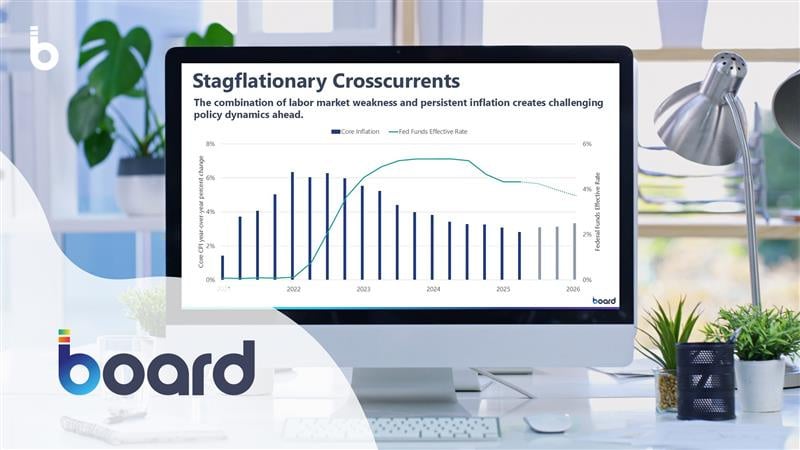

- Why September rate cuts are highly likely, beginning a longer easing cycle

- Three imperatives for leaders: efficiency, cash preservation, and scenario planning

The post-pandemic boom is giving way to a slower-growth equilibrium. For businesses navigating interest rates, consumer demand, and supply chain uncertainty, this outlook provides essential context for Q4 and beyond.